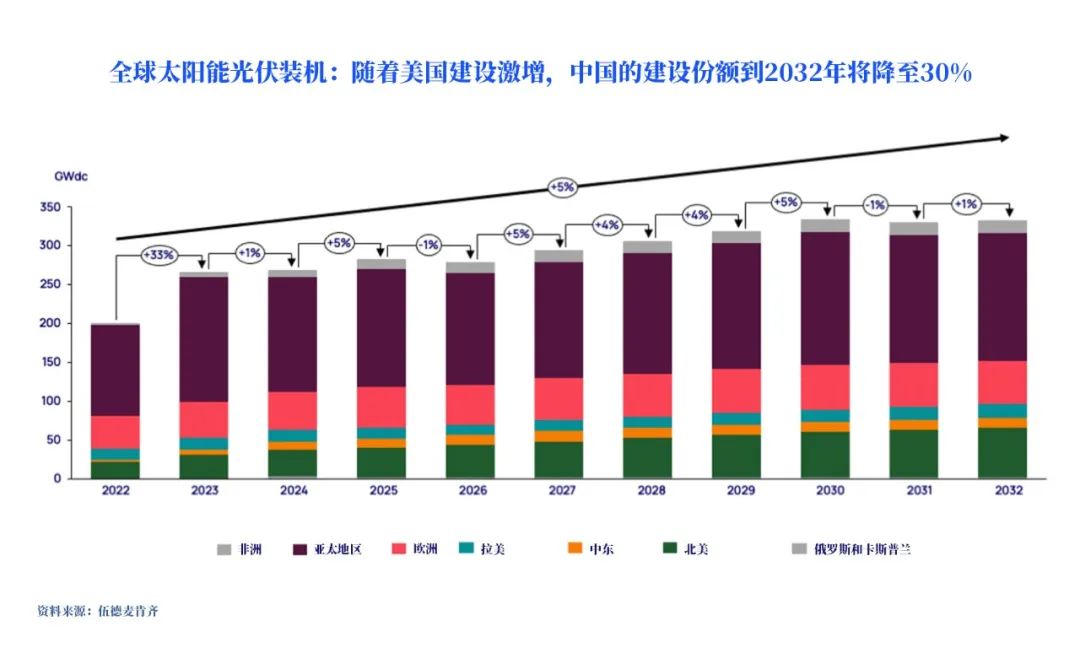

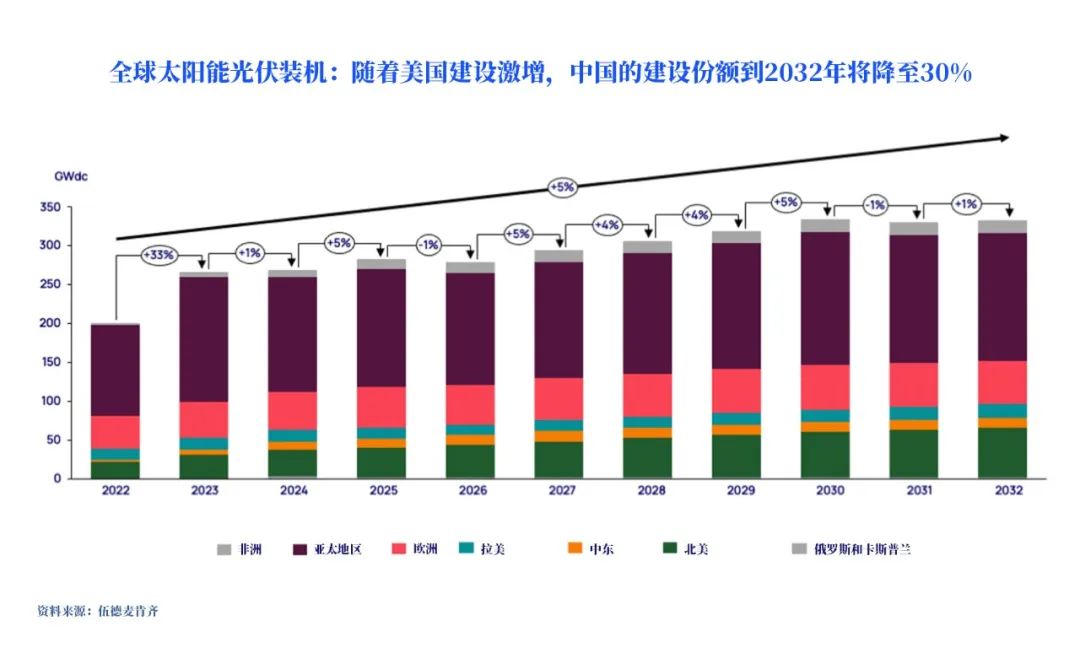

Global solar PV installations are expected to approach 270 GWdc in 2023, and construction will continue to accelerate.

In recent years, the solar energy industry has shined brightly. Installation records are being broken time and time again – and it looks like 2023 will be no exception. But there are bright spots and shadows in the global outlook.

Our latest Global Solar PV Market Outlook update explores the global trends and regional differences that inform our forecasts, helping the industry better understand and make more informed decisions in this fast-paced industry.

Solar construction continues to accelerate in all regions

We expect global PV construction to reach record levels in 2023, approaching 270 GWdc. This number will continue to accelerate to 330 GWdc per year by 2032, driven by the following factors:

Ambitious renewable energy targets

increase electrification

Phasing out coal-fired power plants

energy security concerns

Expand policy support

The levelized cost of energy (LCOE) of solar energy has decreased.

China continues to dominate the solar supply chain

China will continue to lead in PV manufacturing for at least the next five years. We expect the country's export focus to shift from components to upstream cells and silicon wafers. Policy incentives for local PV manufacturing in the US, Europe, and India are not expected to significantly dent China's market share in the short term.

Meanwhile, a massive expansion of Chinese manufacturing capacity is pushing solar installations to record levels. Despite the heightened risk of curtailment, developers are taking advantage of plunging polysilicon prices to rapidly expand utility-scale solar plants.

U.S. solar expected to recover 39% YoY in 2023

The U.S. solar industry experienced its largest first quarter on record in the first quarter of 2023. The Inflation Reduction Act (IRA) supported an increase in US development of more than 3 GW, a 25% year-on-year increase. U.S. solar is on track for a 39% year-over-year recovery this year, driven by a healthy development pipeline and continued supply chain relief, as well as progress made by importers in complying with the Uyghur Forced Labor Prevention Act (UFLPA).

U.S. utility-scale solar installations rebounded strongly by 66% year-over-year in the first quarter as previously delayed projects came online, even as headwinds such as interconnection delays and lingering supply chain challenges remained. While residential solar also hit a record in the first quarter of 2023, economic uncertainty is slowing sales.

Meanwhile, deal activity for solar assets in the Americas has declined compared to 2022. After U.S. IRA-driven euphoria, the first quarter in the space was relatively quiet as developers evaluated new opportunities. Canada helped partially offset this – with increased interest in the growing Alberta solar market, attracting 2.3 GW of deals in the province.

In Europe, UK leads residential solar growth

European household and non-household electricity tariffs fell faster than expected in the first months of 2023, falling by an average of 27% due to lower gas demand in March. Solar installations in Q1 2023 have not yet reflected this, but given inflation and rising interest rates, we expect more modest growth compared to last year's impressive growth.

The first quarter of 2023 saw the best quarterly residential PV installations in the UK in seven years. The level is double that of the first quarter of 2022. We believe this is partly due to a backlog of contracts from 2022, when wait times were reported to be as long as a year. If this pace continues, UK residential PV installations will grow by at least 60% by 2023.

At the same time, Romania has become the number one emerging market for distributed photovoltaics in Europe. We expect cumulative distributed PV installations to reach 6.5 GWdc by 2027. The €610 million subsidy program is expected to support 150,000 home installations, driving a 112% year-on-year increase in our residential forecast for the Eastern European market to 2023.