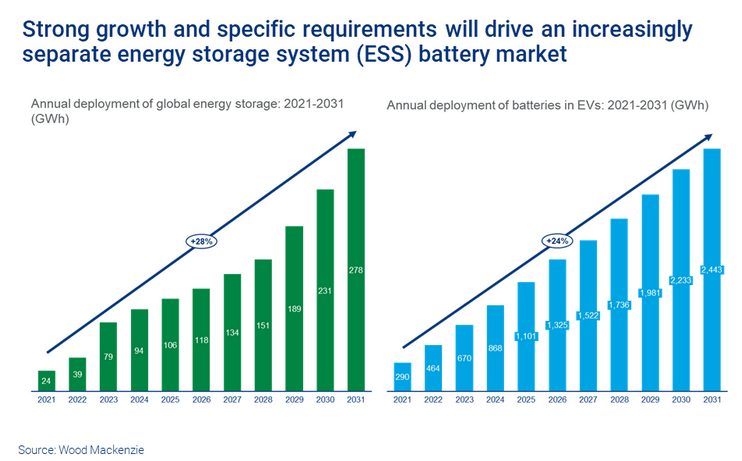

ESCN News: The exponential growth of installed capacity of energy storage systems has created a new competitive landscape for battery manufacturers. Whether diversifying into the electric vehicle (EV) market or focusing on battery energy storage systems, battery suppliers have an excellent opportunity to capitalize on the industry's strong growth over the next decade.

One of Wood Mackenzie's recent series of technical and market reports on energy storage systems provides an in-depth look at the impact of the energy storage market on lithium-ion battery design. Three key trends to monitor closely are outlined below.

The difference between energy storage system batteries and power batteries is becoming more and more obvious

Various factors such as technological advancements, market dynamics, manufacturing practices, and policies are driving the rapid transformation of the lithium-ion battery market. As the adoption of battery energy storage systems accelerates, the industry has responded by introducing specific performance requirements for these systems, differentiating them from EV batteries.

While electric vehicle batteries are primarily focused on increasing energy density to extend range and reduce charging time, batteries designed for energy storage systems prioritize factors such as cost-effectiveness, durability, and extended usage time. In addition, the batteries used in the storage system are designed to last significantly longer, accommodating up to 10,000 charge and discharge cycles, roughly three times that of a traction battery. As the demand for long-duration battery energy storage applications continues to grow, the differences between these two types of batteries are becoming more pronounced.

In addition, incentive policies will play a crucial role in shaping the differentiation of the battery market. For example, the US government’s recently introduced Inflation Reduction Act provides an additional 10% investment tax credit for battery storage systems with at least 40% domestic production, raising the threshold to 55% by 2029. Electric vehicle batteries face stricter requirements on sourcing and traceability of critical minerals. These stricter regulations could drive up production costs, leading to a clear separation of battery supply in the electric vehicle and battery storage markets to avoid unnecessary price increases for batteries.

Advances in Lithium Iron Phosphate (LFP) Batteries for Energy Storage Applications

With the continuous development of advanced silicon-based and lithium metal anode technologies, as well as emerging innovations such as solid-state batteries, the focus of battery manufacturers will often prioritize the electric vehicle and consumer electronics markets. These technologies are designed to increase battery energy density, making them ideal for portable applications.

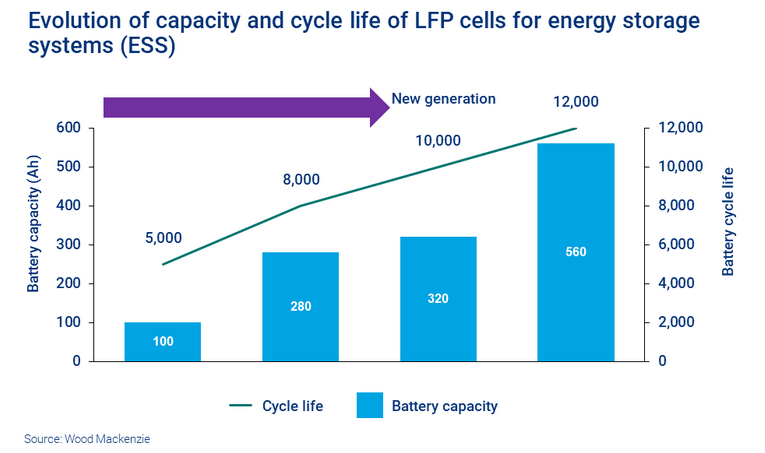

In the field of battery storage, however, lithium iron phosphate batteries are quickly gaining traction for several compelling reasons. LFP batteries are cost-effective with enhanced safety features, longer cycle life, and a richer supply of iron and phosphate.

In addition, another promising battery technology is on the horizon, sodium-ion batteries, which are rapidly moving towards commercialization. Sodium-ion batteries function similarly to lithium-ion batteries, but have the advantage of being less susceptible to price fluctuations in lithium, cobalt and nickel. This enhances their attractiveness for energy storage applications, making them attractive alternatives in the growing field of batteries.

Cost reduction is the driver of continuous innovation in battery size and shape in the energy storage market. Increasing the capacity and size of batteries is an important way to reduce costs. This strategy reduces the number of modules in the battery storage system, thereby reducing the bill of materials (BOM) cost. In addition, it simplifies the assembly and integration process, reducing the management burden of the battery management system (BMS).

In grid-scale applications, the new standard for lithium iron phosphate (LFP) batteries has become 280Ah, with some models up to 560Ah. The batteries also exhibit an impressive number of charge and discharge cycles, up to 12,000. But it is worth noting that larger batteries require higher manufacturing capacity and stricter safety management.

In terms of battery shape, prismatic batteries currently dominate grid-scale energy storage systems, largely due to their popularity among Chinese battery manufacturers. These cells offer greater space efficiency, but are relatively expensive to manufacture. Cylindrical cells, on the other hand, offer a safer, cheaper, more straightforward production process and are more cost-effective in the long run due to their longer life. Wood Mackenzie predicts that the latest generation of large cylindrical LFP batteries will be widely used in different energy storage markets within the next decade.